GST Calculator Australia

What Is GST Calculator AU?

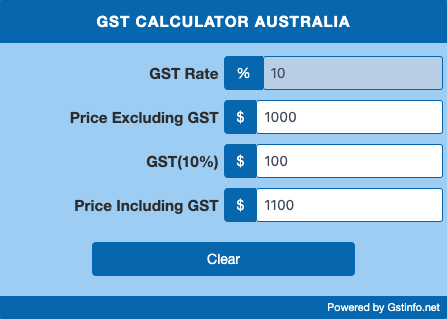

GST Calculator Australia is a tool designed to assist individuals and businesses in calculating the Goods and Services Tax (GST) for various products or services in Australia. Given that the standard GST rate in Australia is 10%, this calculator simplifies the process of determining the GST amount that should be added to the sale price of goods and services, or calculating the original price before GST from the total price.

How to Calculate GST (Goods and Services Tax)?

- Calculating GST Amount: To find out how much GST is to be added to a product or service, you input the original price and apply the 10% GST rate. For example, if a product costs $100, the GST would be $10, making the total price $110.

- Determining Original Price Before GST: If you have a total price that includes GST and need to find the original price before GST, the calculator can work backwards. For a total price of $110, the original price before GST would be $100.

- Useful for Various Transactions: This tool is particularly useful for businesses that need to add GST to their prices or for individuals who want to understand how much GST they are paying. It’s also helpful in accounting and financial reporting.

IGST Calculator Australia (Australian GST calculator) is a practical tool for quickly and accurately calculating the 10% GST on goods and services, ensuring compliance with Australian tax regulations.

GST in Australia

In Australia, the Goods and Services Tax (GST) is a comprehensive tax imposed at a standard rate of 10% on most goods, services, and other items that are sold or consumed within the country. This tax system was introduced on July 1, 2000, as part of a significant tax reform initiative. While the GST applies broadly, there are specific exemptions, including certain types of food, healthcare services, and educational courses. In addition to standard taxable sales, the system includes GST-free sales, where the seller does not charge GST but can claim credits for the GST paid on business inputs, and input-taxed sales, where GST is not charged on the sale and the seller cannot claim credits for the GST included in the price of inputs. This structure ensures a comprehensive yet fair taxation system, covering a wide range of economic activities while providing necessary exemptions and concessions.