GST Calculator Canada Online

What is a GST Calculator? (Sales Tax Calculator)

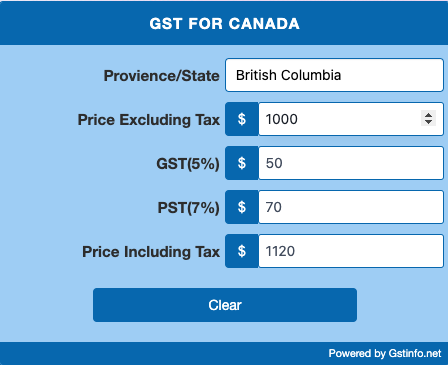

A GST Calculator Canada is an online tool designed to help calculate the Goods and Services Tax (GST) applied to goods and services in Canada. This calculator is particularly useful because, in addition to the federal GST, some provinces have Harmonized Sales Tax (HST) or Provincial Sales Tax (PST), which can vary by region.

- GST Calculation: The calculator computes the GST amount by applying the federal GST rate to the base price of goods or services.

- HST and PST: In provinces where HST is applicable, the calculator combines the federal GST with the provincial rate to calculate the total tax amount. In provinces with separate PST, it calculates GST and PST independently and adds them to the base price.

- Versatility: The calculator adjusts to the specific tax rates applicable in different provinces and territories, making it a versatile tool for users across Canada.

- Ease of Use: Users simply input the base price of a product or service, and the calculator automatically computes the total price including GST, HST, or PST, depending on the province.

This tool is invaluable for businesses and consumers in Canada for accurately calculating taxes on goods and services, ensuring compliance with the varied tax rates across the country.

| Canada’s Province | Rate type (HST, GST, PST) | Provincial rate | Canada rate | Total |

|---|---|---|---|---|

| Alberta | GST | 0% | 5% | 5% |

| British Columbia (BC) | GST+PST | 7% | 5% | 12% |

| Manitoba | GST+PST | 7% | 5% | 12% |

| New-Brunswick | HST | 10% | 5% | 15% |

| Newfoundland and Labrador | HST | 10% | 5% | 15% |

| Northwest Territories | GST | 0% | 5% | 5% |

| Nova Scotia | HST | 10% | 5% | 15% |

| Nunavut | GST | 0% | 5% | 5% |

| Ontario | HST | 8% | 5% | 13% |

| Prince Edward Island (PEI) | HST | 10% | 5% | 15% |

| Québec | GST + QST | 9.975% | 5% | 14.975% |

| Saskatchewan | GST + PST | 6% | 5% | 11% |

| Yukon | GST | 0% | 5% | 5% |

Calculate Canadian GST Rate | Province PST and HST

In Canada, the tax system on goods and services includes the Goods and Services Tax (GST), Provincial Sales Tax (PST), and Harmonized Sales Tax (HST), with rates varying across provinces. The GST, a federal tax, is set at 5% nationwide. PST rates differ by province, for instance, Saskatchewan has a PST of 6%, while British Columbia’s PST is 7%. Some provinces, like Alberta, do not have PST. The HST, a combination of GST and PST, is used in provinces like Ontario (13%), New Brunswick, Newfoundland and Labrador, Nova Scotia (all at 15%), and Prince Edward Island (15%). This harmonization simplifies taxation but results in different total tax rates in HST-using provinces compared to those using separate GST and PST systems.