GST Calculator India

What is a GST calculator?

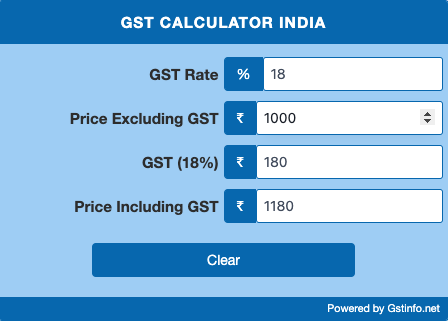

A GST calculator India is a tool designed to simplify the process of calculating the Goods and Services Tax (GST) on various products or services. This calculator helps in determining either the gross or net price of a product based on the applicable GST rate.

- Input the Original Cost: You enter the original cost of the product or service before GST.

- Select the GST Rate: Choose the appropriate GST rate applicable to the product or service (e.g., 5%, 12%, 18%, or 28%).

- Calculation: The calculator then computes the amount of GST by applying the selected rate to the original cost. It can provide two results:

- Gross Price: This is the total cost including GST. It’s calculated by adding the GST amount to the original cost.

- Net Price: If you have the final selling price and need to find out the original cost before GST, the calculator can work backwards to provide this figure.

GST Calculator India

The primary advantage of using a GST calculator is that it saves time and reduces the likelihood of errors in calculating the total cost of goods and services, including the tax component. This tool is particularly useful for businesses, accountants, and consumers who need to quickly figure out tax amounts for budgeting, pricing, or accounting purposes.

GST Rate

- 0.25%

- 3%

- 5%

- 12%

- 18%

- 28%

Goods and Services Tax (GST) In India: Indirect Tax Structure

The Goods and Services (GST) Tax in India is a taxation process that aims to standardize indirect taxes in the country. As the name implies GST is a tax liable on any goods, services, and products so that the business and financial transactions are carried out in a fair, transparent, and streamlined manner. Like many other countries, the GST rates in India are set by the government. Any business activity and sale and purchase of goods and services must comply with the set GST rules in India. The current GST system in India was introduced in 2017 and replaced almost all indirect taxes in India.

Consequently, the Central government and state governments impose 3 main categories of GST tax in India:

- Central Goods and Services Tax (CGST): This tax is collected in all states and goes to the central government of India.

- State Goods and Services Tax (SGST): state government imposes and collects SGST within their states.

- Integrated Goods and Services Tax (IGST): this is collected outside states and taken by the central government.

If you are an individual or a business entity liable for taxes in India, you must understand how the tax system works in India, the GST India rate, and the rules of compliance. Here is your comprehensive guide on GST in India, how to calculate GST, and different tax and tax rates and GST Calculator India, that you need to know if you do any kind of sales and purchases of goods, products, and services in India.

What is GST Structure and GST Rate in India?

In India, the GST rate varies depending on the product therefore, As mentioned above there are three types of Taxes i.e., CGST, SGST, and IGST, and the rate of GST depends on the type of good, product, or service you sell. The tax structure is further shaped by the different rates and India GST laws and rules categorize tax rates as follows:

- Schedule I: 0%Rated

- Schedule II: 0.25%

- Schedule III: 3%

- Schedule IV: 5%

- Schedule V: 12%

- Schedule VI: 18%

- Schedule VII: 28%

Once a business entity registers for GST in India, it gets a GST identification number (GSTIN) that can be used for filling GST returns in the country. Businesses in India must comply with GST laws and pay GST as suggested by the Central government and the state governments.

FAQs