Free VAT Calculator UK

what is a VAT calculator UK?

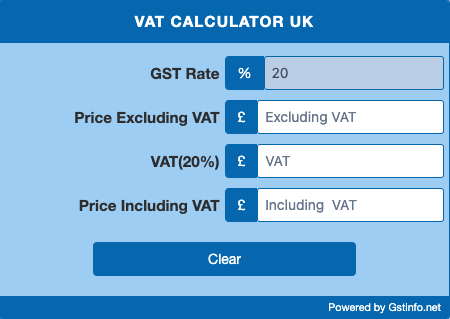

A VAT (Value Added Tax) calculator is a tool designed to help calculate the amount of VAT that needs to be added to or subtracted from a particular price. This tool is particularly useful in countries where VAT is a common form of tax on goods and services. The VAT calculator simplifies the process of applying VAT rates to the net amount (before tax) or gross (including tax) prices of products or services.

How VAT calculator work?

The VAT calculator UK is a convenient tool for businesses, accountants, and individuals, enabling them to quickly figure out the VAT component for pricing, budgeting, or accounting purposes. It’s especially useful in regions where VAT rates change or vary, helping to ensure accuracy in financial calculations in the correct VAT percentage, by simply calculating and subtract VAT.

How VAT calculator work out VAT?

- VAT register threshold: Businesses must register for VAT when their sales exceed £67,000 (as of April 1, 2008). Voluntary registration is also possible before reaching this threshold.

- VAT Rates: VAT is charged at different levels:

- The standard VAT rate of 20 % applies to most items.

- A reduced rate of 5 % applies to certain items, such as mobility aids for the elderly, smoking cessation products, domestic electricity and gas, children’s car seats, and more.

- A zero rate (without VAT) applies to items like cycle helmets, protective boots and helmets for industrial use, children’s clothes and footwear, baby wear, and certain other products.

- VAT-Rated and VAT-Exempt Items: Not all goods and services are vat inclusive. Some items are VAT-exempt, inclusive rent, private education, health services, postal services, finance and insurance, and gambling.

For more detailed information on goods and services subject to different VAT rates, you can visit the HMRC website: HMRC VAT Rates.

IVAT is a significant tax on business transactions in the UK, with varying rates depending on the type of goods or services. Businesses play a crucial role in collecting and remitting this tax to the government.

VAT Refund UK Tourist

Tourists visiting the UK for less than 12 months are eligible for a VAT refund, a scheme allowing them to reclaim VAT paid on goods purchased during their stay, provided these goods are taken out of the UK within three months of purchase. To claim this refund, tourists need to shop at stores offering VAT-free shopping, request a VAT 407 form at the time of purchase, and present this form along with the goods and receipts to customs upon departure from the EU. The refund, not applicable to services like hotel stays or car rentals, can be processed in various ways, such as credit card, bank cheque, or cash. There are restrictions, including a minimum spend requirement, and the goods must be exported within three months from the end of the month of purchase. Tourists facing issues with VAT refunds should contact the retailer or the refund company. This system provides a financial benefit to non-EU tourists, making shopping in the UK more attractive.