GST return due dates in New Zealand are set by the Inland Revenue Department (IRD) and as per the rules GST is due on the 28th of every month. The only two exceptions to this rule are:

March Balance Date – Not GST Registered

| 28 August | 1st Provisional Tax Instalment Due |

| 15 January | 2nd Provisional Tax Instalment Due |

| 7 April | Terminal Tax Payment Due |

| 7 May | 3rd Provisional Tax Instalment Due |

March Balance Date – Two Monthly GST

| 28 June | April/May GST Return & Payment Due |

| 28 August | June/July GST Return & Payment Due and 1st Provisional Tax Instalment Due |

| 28 October | August/September GST Return & Payment Due |

| 15 January | October/November GST Return & Payment Due and 2nd Provisional Tax Instalment Due |

| 28 February | December/January GST Return & Payment Due |

| 7 April | Terminal Tax Payment Due |

| 7 May | February/March GST Return & Payment Due and 3rd Provisional Tax Instalment Due |

March Balance Date – Six Monthly GST

| 28 October | April/September GST Return & Payment Due and 1st Provisional Tax Instalment |

| 7 April | Terminal Tax Payment Due |

| 7 May | October/March GST Return & Payment Due and 2nd Provisional Tax Instalment Due |

May Balance Date – Two Monthly GST

| 28 August | June/July GST Return & Payment Due |

| 28 October | August/September GST Return & Payment Due and 1st Provisional Tax Instalment Due |

| 15 January | October/November GST Return & Payment Due |

| 28 February | December/January GST Return & Payment Due and 2nd Provisional Tax Instalment Due |

| 7 April | Terminal Tax Payment Due |

| 7 May | February/March GST Return & Payment Due |

| 28 June | April/May GST Return & Payment Due and 3rd Provisional Tax Instalment Due |

June Balance Date – Two Monthly GST

| 28 August | July/August GST Return & Payment Due |

| 28 November | September/October GST Return & Payment Due and 1st Provisional Tax Instalment Due |

| 28 January | November/December GST Return & Payment Due |

| 28 March | January/February GST Return & Payment Due and 2nd Provisional Tax Instalment Due |

| 7 April | Terminal Tax Due |

| 28 May | March/April GST Return & Payment Due |

| 28 July | May/June GST Return & Payment Due and 3rd Provisional Tax Instalment Due |

Taxes of different types i.e., income tax, provisional tax, etc. are applicable in New Zealand and each has a different set of rules and due dates and income tax return rules. Likewise, the Goods and Services Tax (GST) is a type of consumer tax that businesses are liable for in New Zealand.

It is important to file GTS returns on time on these New Zealand GST due dates as it prevents you and your business from incurring penalties. As a business with a turnover of $60,000 and above, you must register for GST and file GST on due dates at the end of the tax year set by the government.

This guide gives an overview of GST due dates and filing frequency so that you are aware of GST New Zealand Due Dates 2023 – 2024 and pay your taxes on time.

GST Return Filing Frequency and Inland Revenue Department Deadlines NZ

As a business or entity engaged in any sort of taxable activity like buying and selling of goods and services, you must be registered for GTS at the Inland Revenue Department. The criteria mentioned above are that any business that has a turnover of $60,000 per annum or is expected to hit this amount in a taxable period is required to file GST in a payable time. Here is how the GST and Filling process works:

- You must register for GST at IRD and get myIR number.

- Select a filing frequency to file your taxes. There are three filing frequencies that are suitable for various businesses:

- Monthly GST filing frequency

- Two-monthly filing frequency

- Six-Monthly filing frequency

Generally, if the business is huge with a turnover of $24 million in any twelve-month period, it is advisable to file a GST on a monthly basis. So if your business hits the mark of $24 million in April, then the GST return due date will be 28 May. By this date you must pay GST to IRD via the online account. A tax agent or software can be used to make this process hassle-free and smooth.

Two-monthly basis filing frequency is suitable for businesses with an annual income that is less than $24 million. The two-monthly filling process is helpful to keep records straight and not pile things up.

Six-monthly basis filing frequency is for those with a turnover of $500,000 in any 12-month period. This is suitable for businesses with fewer sales and it can be tricky since it requires keeping a diligent record of six months of paperwork and accounts of sales and purchases. Make sure you have invoices, bills, and other documents to correctly file and comply with tax returns.

As a business and GST-registered entity, you can select how frequently you want to file GST. Therefore, the best way to do so is to look at the record of your sales and purchases and see if you need to file frequently to manage the record on a monthly basis or if your sales are not high then doing a 6 monthly GST is more suitable, now business can calculate their GST using gst online calculator

Once you decide on the GST filing frequency, you can follow the New Zealand Tax Return Due Date Calendar 2023-2024 to file GST on time without any delays.

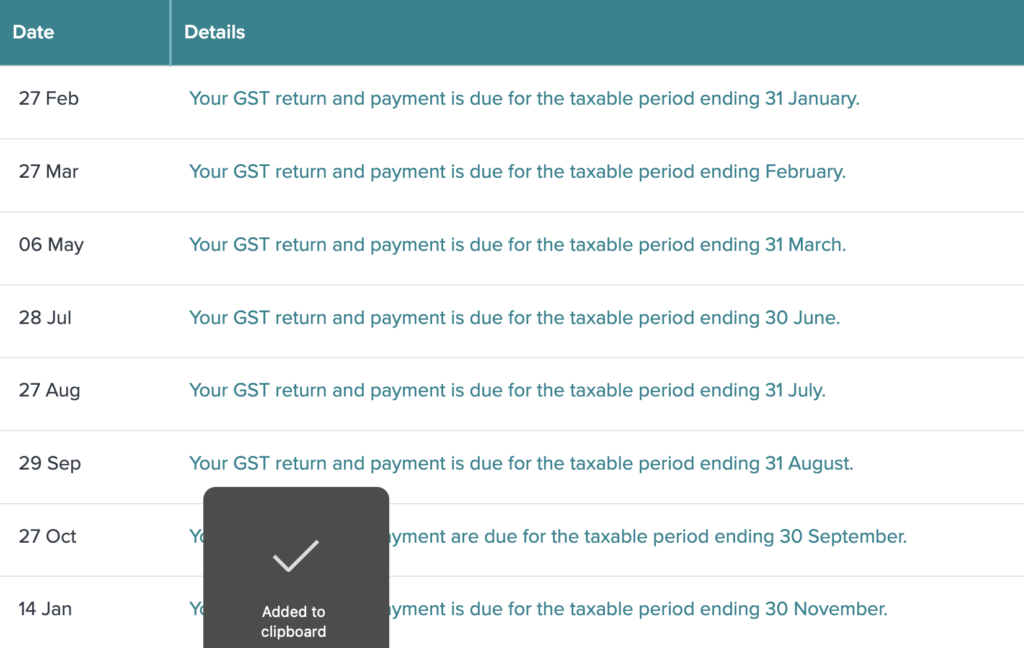

New Zealand Tax Return Due Date Calendar 2023-2024

This is the official calendar of GST New Zealand Due Dates 2023-2024. Remember these key New Zealand tax dates for the upcoming tax year.

| Date | Details |

| 27 Sep | Your GST returns for the taxable period ending 31 August. |

| 29 Oct | for the taxable period ending on 30 September |

| 27 Nov | GST return and filing for the period ending on 31 October |

| 14 Jan | Your GST return and payment is due for the taxable period ending 30 November. |

| 28 Jan | taxable period ending on 31 December, the GST payment due date is 28 January |

| 27 Feb | for the taxable period ending 31 January |

| 27 Mar | the taxable period ending February |

| 06 May | GST and payment is due for the taxable period ending 31 March. |

| 28 Jul | for the taxable period ending 30 June |

| 27 Aug | GST return and payment is due for the taxable period ending 31 July. |

These are the key tax dates that you as a business owner or your accountant or tax agent must remember for the current year. There is also an option to use accounting software that makes tax payments on a set time and date.