Countries across the world are making an effort to ease the sales tax burden on their citizens. Economic specialists have suggested a number of reforms in this process of improving affordability through an indirect tax system. Among such efforts, the value added tax (VAT) or goods and services tax (GST) has taken the world by storm.

A number of countries were successful in reducing the tax burden through the VAT system and turned themselves into what they say is a ‘tax-heaven.’ However, the varying nature of the VATs led to an individualized rate for each country. As a result, some countries ended up implementing a comparatively higher rate than their counterparts.

In this article, we will talk about an overview of taxation around the world, create an understanding of tax-related terminologies and list down the top 5 countries with highest GST rates.

A Recap of Goods and Sales Tax (GST)

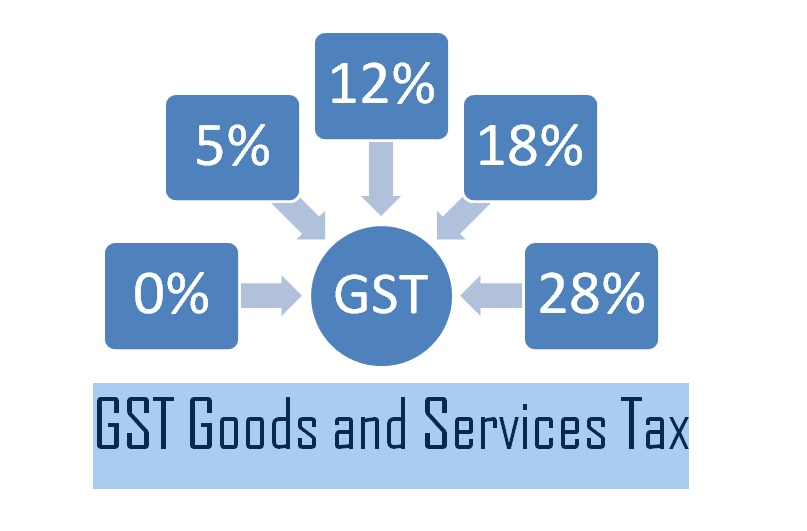

Goods and Sales Tax (GST), often termed as value-added tax (VAT,) is the type of tax which is levied on goods and services at multiple value points across the chain. This type of tax is not only collected from the end consumer but also from the businesses that are procuring services. The tax is then remitted back to the government by the VAT registered businesses. This tax is often coined with indirect taxes and is often associated with the consumption of goods or the rendering of services.

Unlike the Sales Tax system, which is paid by the consumer only, the GST is paid by the end consumer at the value chain, which can be both people and businesses. The government decides a standard rate for GST, which is then applicable across the whole of the country.

The purpose of the goods and sales tax is to reduce the burden on the lower-income class. As a result of its contribution to social and economic empowerment as well as due to its simplified taxation process, this value-added tax system has been acquired by over 170 countries across the globe. A step further, some countries have even introduced exemptions, flat or reduced VATs on certain goods and services, such as food, healthcare, and education supplies to name a few. Others have taken the measures of VAT credits to reduce the tax burden on consumers, especially those belonging to the lower income class.

For businesses to be eligible for the VAT, they need to produce revenue beyond a certain threshold and qualify for other certain terms as well. These thresholds and other qualification criteria are specific to each country and are pre-determined by their state or government departments. In the UK specifically, the businesses need to show a turnover of at least £85,000 and above.

Contrary to popular opinion, some critics still blame the GST for burdening the lower-income classes more than the higher income ones. For some countries, these rates have been termed as the highest rates. In the upcoming section, among the list of countries with the highest rate, we are going to highlight the top 5 countries with highest GST rates in 2023!

Differentiating between Standard VAT, Reduced VAT and Flat VAT Rates

When talking about the standard, reduced and flat value added tax rates or goods and services tax rates, the difference is essential for businesses to understand, especially for those who are operating on a smaller scale. Each type of taxation scheme has its own perks and challenges. Many countries across the globe have adopted these VAT or GST schemes and embedded them into their taxation systems. However, after certain deadlines, these VAT schemes may or may not be applicable to the taxation systems of a specific country.

Before we talk about the top 5 countries with highest GST rates in 2023, let’s discover in detail the differences between standard VAT, reduced VAT and flat VAT rates and figure out what do they really mean for consumers as well as businesses:

Standard VAT Rate

Under the standard VAT Rate scheme, the businesses need to consider the VAT collected from the consumer and the VAT it has paid to the supplier. The difference is either owed to or from the state or government department. This type of scheme applies to a majority of the goods and services and this rate can not be low below a certain percentage. For example, in European countries, the standard VAT rate can not be less than 15%. Furthermore, this VAT rate comes with standard eligibility criteria in terms of revenue generation and other terms & conditions.

For instance, in the context of the UK, business owners, freelancers, self-employed or even sole traders by law are required to add value-added tax to their products or services and submit an equivalent VAT to the HMRC. Additionally, if the reclaim is more than the remittance owed, HMRC is obligated to provide a refund based on the difference.

Reduced VAT Rate

A reduced rate of VAT is a tax rate set at a lower percentage than the standard VAT rate for certain goods and services. This reduced value added rate is often applied to consumer goods otherwise deemed as essentials. This often reduces the tax burden at the consumer end.

By applying a lower tax rate through the reduced VAT scheme, the government aims to reduce the financial burden, enhance affordability and improve economic empowerment. This type of rate is often applied to foods, books and children’s clothing. The criteria for a reduced VAT rate, however, differs from country to country across the globe.

While discussing the case of the UK, back in 2021 and 2022, the reduced GST rate was introduced at 5% and 12.5% respectively, which have recently expired after completing their deadlines.

Flat VAT Rate

A flat rate scheme is another way for businesses to check their eligibility for the VAT system, which is applicable to quarterly returns. This scheme has figuratively simplified record-keeping for small-scale businesses.

Under this scheme, the businesses apply a fixed tax rate to the gross sales eligible for a tax return, which is then remitted back to the government. Instead of the difference in the standard scheme for VAT, the result of the fixed rate on gross sales is what the businesses actually owe to the HMRC. This straightforward calculation thereby makes it easier for smaller businesses to file their taxes. However, the businesses following the flat VAT rate criteria are no longer eligible to receive reclaims based on the purchases.

The lower the VAT-based expenditures from the supplier end, the more the flat VAT liability becomes nominal for the businesses. In the UK alone, if the VATable expenditures are on a higher level, the flat VAT rates may supersede the standard VAT rate.

Discovering Five Leading Countries with the Highest Tax Rates

While talking about the top 5 countries with the highest goods and services (GST) rates in the world, each country has adopted the system as per the taxation rules and regulations. A majority of countries across the world follow a standard VAT rate for all goods and services, but in some cases these rates can vary depending upon the adaptation mechanism.

Since its inception in France back in 1968, the VAT system has been quickly adopted and implemented by over 87% of the countries in the world. A large number of countries have been able to achieve their goal of reducing the tax burden on their citizens and thereby, entering the category of tax heavens. However, on the other hand, VAT in other countries have led to the highest tax rate, causing a tax hazard situation.

In the upcoming sections, we are going to talk about the top 5 countries with highest GST rates and subsequent reduced tax rates:

India Top 5 Countries with Highest GST Rates

When talking about countries whose tax rate is the highest in the world, India tops the list. The GST in India can go as high as at a whopping rate of 28%. This highest VAT rate is applicable to certain consumer goods, such as cement, chocolate, air conditioning and automobiles to name a few. The Indian GST was recently added to the Indian Taxation system back in 2005, making it lead the list of top 5 countries with highest GST rates.

However, the Indian government has defined two types of standard VAT rates for its people, the first one being 18% and the second one at 12%. The 18% standard VAT is applicable to items, such as banking, telephone, certain types of restaurants, TVs, gaming consoles, etc. On the other hand, the 12% VAT rate under the standard scheme is applicable to goods and services such as mobile phones, construction, intellectual property and so on and so forth. The Indian government has also introduced a reduced VAT rate, which applies to essentials such as sugar, transportation, tea, coffee, medicine and advertising.

Brazil Top 5 Countries with Highest GST Rates

In the list of top 5 countries with highest GST rates in the world, the standard VAT or GST rate in Brazil varies among all of of its 26 states and the federal district from 17% to 25%. In Rio de Jenario, the VAT is set at 19%, in São Paulo and Paraná e Minas Gerais it is set at 18% whereas the remaining states have a GST rate of 17%. The varying rate of GST also depends on the type of goods consumed or services rendered. Brazil adopted the goods and services (GST) taxation system back in 1984.

Brazil has also implemented a reduced GST rate of 12% on interstate imports, whereas 7% on certain transactions in designated states and in some cases super reduced to 4% as well. The Brazilian government has not set a threshold for businesses to be liable for the VAT taxation system.

Morocco

The Moroccan government has implemented a standard GST rate of 20% on all goods and services, with fewer exemptions. This standard rate is considered one of the highest tax rates in the world. This tax is levied at all value-addition points across both the B2B and B2C supply chain and is handled by the Ministry of Finance. in 1986, the Moroccan government took the initiative to implement GST.

Similar to other top 5 countries with highest GST rates in 2023, a reduced rate of 14% GST is applied to domestic transportation, excluding train services within Morocco. The Moroccan government has further implemented a reduced rate of 10% on the hospitality and transportation industry, which covers petroleum products, banking, hotels as well as restaurants. To further ease the financial burden, they have reduced the standard VAT rate of 20% to 7%, which is applicable to goods and services, such as pharmaceuticals, water supply, medicines and electricity. Last but not least, the VAT tax exemption is applicable to export of goods and services plus agricultural supplies.

Turkey

As we discover the top 5 countries with the highest GST rates, Turkey is among the list with a standard VAT rate of 20%, which was recently increased in July 2023 from a previous rate of 18%. This tax is levied on a majority of the goods and services across the supply chain. Similar to Brazil, the Turkish government has not set a threshold for local businesses and interestingly, there is no VAT liability for businesses with no warehouses. The VAT in Turkey was introduced back in 1985, with a standard rate of only 10%.

Turkey has also implemented GST at a reduced rate of 10% (previously 8%), which covers the majority of the basic essentials, such as books, medical supplies & products, items of clothing, food etc. Furthermore, the Turkey government has introduced a super-reduced VAT rate of 1%, which covers listed residential properties, funeral services, meat, bread agricultural supplies and newspapers, to name a few.

Ukraine

Last but not least, another country in the world with the highest GST rate would be Ukraine. The standard GST rate in Ukraine is set at 20%. This standard rate is applicable to all goods and services, excluding those with tax exemptions. With VAT’s introduction in 1993, Ukraine is the last one among the list of top 5 countries with the highest GST rates.

users can use our online tool to calculate GST online gst calculator nz

Among the VAT-taxed countries in the world, Ukraine has introduced a reduced VAT rate of 14% for agricultural products, such as corn, soybeans as well as sunflower seeds and imports. Additionally, a reduced rate of 7% GST is levied on consumer goods, including medical products and supplies, the tourism industry, culture, temporary accommodation services, domestic cargo or air transportation, and ticket supply for sporting events both at local and international levels, to name a few. Last but not least, a standard VAT rate of 0% applies to export as well as reexport of goods. Ukraine has not defined any mechanism for foreign registered businesses as of yet.