The term ‘tax’ has always been the center of discussion and often people are discussing how

much we are paying in the process. The fundamental purpose of tax collection is to fund

government expenditure, which often makes people wonder how much citizens in other countries are paying. For businesses, these discussions carry even more importance because such

comparison often gives people a realistic overview of where it would be more profitable for them

to set up a business.

There are five categories of taxes collected from New Zealanders: individual,

consumption, property, corporate, and international. In this article, we will target the goods and

services tax and compare the GST systems of New Zealand vs. other countries, especially in

the context of OECD countries. But before doing so, we need to understand the taxation system

in New Zealand and how it benefits the government and citizens at the same time!

Tax Overview of New Zealand

The government of New Zealand relies on the taxes collected from individuals, corporations, and

businesses to drive benefits for New Zealanders. The Inland Revenue Department, or IRD,

collects these taxes on behalf of the NZ government. The International Tax Competitiveness

Index (ITCI), an organization in place to competitively review the tax systems of 38 counties

under the OECD region, has placed New Zealand in third place for promoting a lower tax burden

on businesses and standardizing the majority of its tax code. New Zealand has become the go-to

place for local as well as international traders and businesses due to its infrastructure in place for

providing them with an optimal environment to establish and expand themselves.

Before comparing the GST systems of New Zealand vs. other countries, we need to establish

a sound understanding of different categories of the taxation system, as they are in place in

accordance with the OECD charter and guidelines:

Individual Taxation System

In New Zealand, individual taxes are collected on either individual or household income to fund

the operational expenditure of the government. The percentage of these taxes is directly

proportional to a person’s or a business’ income. A higher personal income means a proportional

increase in the tax collected. This personal income tax is also referred to as Pay-As-You-Earn

(PAYE) tax and is often levied at a marginal tax rate from New Zealanders.

Consumption Taxation System

In terms of the consumption tax, it is charged mostly on goods and services. In the OECD

countries, this type of tax is often categorized under the value-added tax system, including the New

Zealand. Goods and services (GST) are often collected in multiple stages and the tax credits are

provided to businesses under certain conditions. To further facilitate the businesses, there are

special tax rates under reduced GSTs and Excise taxations.

Property Taxation System

Under the property taxation system, taxes are applied to business or personal assets. These taxes

on property, usually collected on tax and land, are usually paid on set dates. However, there are

certain exemptions when it comes to inheritance laws in New Zealand.

Corporate Taxation System

The corporate tax is collected on the revenue generated by corporations in New Zealand, which

is usually levied by most of the OECD countries. These taxes are usually harmful to the

economy but there have been systems in place to provide subsidies to businesses and enterprises, especially newly established ones, through lower corporate tax rates and general capital allowances.

International Taxation System

Lastly, due to the effect of globalization, businesses settled in one country usually expand to

other countries around the world. In this context, New Zealand has defined a new tax under the

international taxation system to cater to such business activities. The purpose of these taxes is to

reduce the implementation of double taxes by withholding taxes between countries which are

often reimbursed as tax credits.

Benefits of the New Zealand’s Tax System

The NZ government has made sure to devise a tax policy that not only drives the economy but

also creates a more coherent state-level system. The government has been working hard to

maintain a fair tax system, which is often good for the overall earnings and assets of its citizens.

According to a study by the US-based Tax Foundation in 2019, New Zealand’s tax system has

been ranked second in terms of competitiveness and fourth in the context of individual tax across

the globe. Furthermore, the tax-to-GDP ratio of New Zealand has been last marked at 33.8% in

2021, in comparison to the OECD average of 34.1 percent. Some of the key attractions of the

The New Zealand tax system includes:

- There are zero social security taxes for the New Zealanders.

- In terms of healthcare, there are no taxes applied to the general healthcare system.

- There is no tax applied on inheritance.

- The government has exempted its citizens from local or regional taxes.

- There are no payroll taxes for the NZ citizens.

- There have been no taxes applied in the context of general capital gains.

- The property taxes are applicable to land value only, instead of real estate and other improvements in land.

- Lastly, for businesses in loss, the tax is collected on the average profits.

Furthermore, if we talk about the tax laws for the immigrants, the immigrants do not have to pay

for the overseas income, for the first 4 years of living in New Zealand. As a result, the

immigrants are required to pay tax only on personal income for the said duration.

For those who are not only tax residents in New Zealand but somewhere else as well, there is a

possibility of getting taxed double times. In order to avoid that, there is a special international

taxation system in place to receive tax credits on income tax which has already been in another

country. In the upcoming sections, we will be highlighting and comparing the GST systems in

New Zealand vs. other countries to further draw attention towards the imperative benefits of

setting up overseas business here!

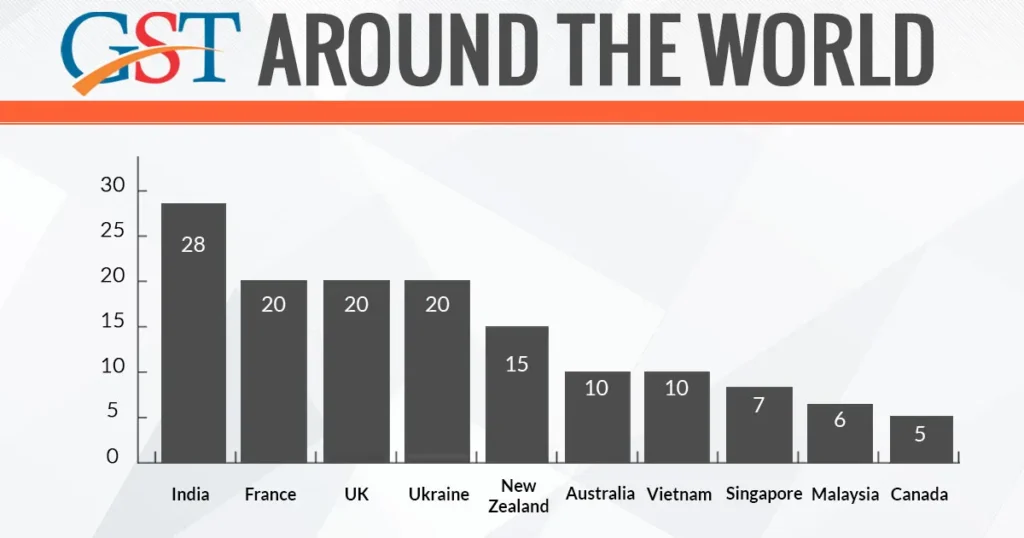

GST System New Zealand vs. other countries

When discussing the goods and services tax system of New Zealand, it is quite simple and

relatively lower than other countries in the world. New Zealand’s government usually charges a flat rate of 15%, which is collected on consumer goods and services as well as some of the imports from other countries. For businesses, claiming back the GST on goods and services that they have procured is a pretty straightforward process.

The broad-based system adaptation of VAT has allowed the National Party, the pioneer of

consumption tax in New Zealand, to collect a majority of the taxation value. Currently, it stands

at 34.1% of the total tax collected from New Zealanders. As a result, the revenue generation is

higher in percentage as inefficient multi-source taxes have been reduced. Moving forward,

we will be highlighting in detail a comparative analysis of the New Zealand GST systems vs.

other countries to draw conclusions based on tax revenues:

Now can use our online tool to calculate GST only in one click nz gst calculator

New Zealand Vs. Australia: GST System

If we talk about the comparison of the GST systems in New Zealand vs. other countries,

especially those in the OECD region, Australia should be the one to begin with. Here is a tabular

representation of how both countries have GST systems in place:

| New Zealand | Australia |

| A broad 10% GST is collected on most of the goods, services, and items sold or consumed in Australia. | A broad 10% GST is collected on most of the goods, services and items sold or consumed in Australia. |

| The minimum threshold for charging GST on goods and services is $60,000 and above. | Once registered for GST, the businesses are required to collect it on goods and services. |

| Depending on the turnover rate, there are three categories of GST period defined for filing GST returns. | A broad 10% GST is collected on most of the goods, services, and items sold or consumed in Australia. |

New Zealand Vs. Poland: GST System

Let’s dive deep into comparing the GST systems in New Zealand vs. other countries by

starting off with Poland, which is summarized below in the tabular form:

| New Zealand | Poland |

| A 15% consumption tax rate is charged for goods and services. | A standard GST of 23% is charged on all taxable goods and services, whereas there are reduced percentages of 8%, 5% and 0% on some of the basic items and transportation. |

| The minimum threshold for GST is set at $60,000 to be charged on goods and services. | A standard GST of 23% is charged on all taxable goods and services, whereas there are reduced percentages of 8%, 5%, and 0% on some of the basic items and transportation. |

| The GST returns are to be filed in either of the three return plans, depending upon the turnover rate. | The GST returns can be filled monthly, quarterly or annually. |

New Zealand Vs. Hungary: GST System

Next and last in the list, we are going to comprehensively compare the GST systems prevailing

in both New Zealand and Hungary in detail as follows:

| New Zealand | Poland |

| A broad-based VAT of 15% is collected on goods and services. | The VAT returns can be filled either monthly, quarterly or yearly and are to be paid at the same time in HUF currency only! |

| $60,000 is the minimum threshold to be eligible for automatic registration of VAT. | A standard VAT of 27% GST is collected in Hungary for most of the goods and services. Hungary has also introduced two reduced rates of 18% and 9% on basic edible items and residential property. |

| The GST returns are to be filed in either of the three return plans, depending upon the turnover rate. | The VAT returns can be filled either monthly, quarterly, or yearly and are to be paid at the same time in HUF currency only! |